Buying a new home brings a lot of excitement… and lots of paperwork. Do you know what documents and approvals to expect and why they’re needed? Let Honor Bank help you gather the correct items to get through every step from a mortgage pre-approval to house closing.

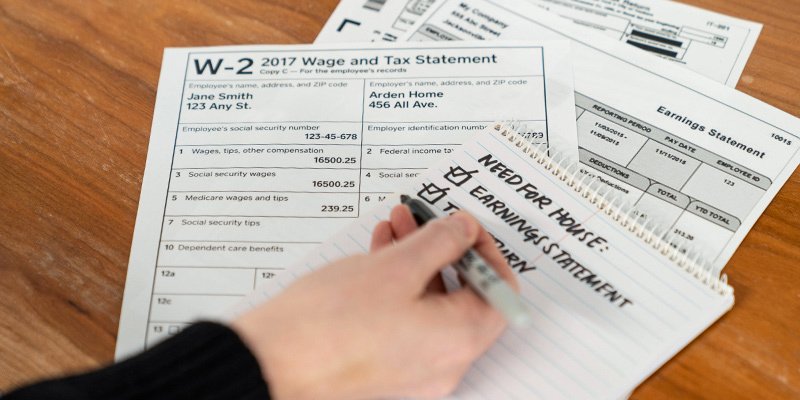

Even before you start looking for a home to buy, certain personal financial statements will be needed by the bank to help them determine how much home you’re able to afford. Due to government guidelines, it’s necessary to prove that you are able to afford the mortgage you’re hoping to qualify for.

Having all your documents and approvals prepared, correct and in order will help you get into the home of your dreams faster!

Check out our ultimate home buying checklist and let Honor Bank help you check off each item as you gather it to make the process a little simpler.

- Credit Report

- As a home buyer, your first step should be to check your credit score and credit report to make sure there are no errors. Knowing your credit score could help give some insight into the type of loans and interest rates you may quality for. The higher the credit score, the lower your interest rate may be.

- Mortgage Pre-approval

- By getting pre-approval first, you’ll know what type of mortgage you are able to afford and that your lender is confident in your ability to make mortgage payments.

- Income Information

- Be prepared to have extensive paperwork to prove your income. This includes W-2s and paystubs from 30 days or even up to two years back.

- If you’re fully self-employed, you will need to prove your income through profit and loss statements, bank statements and 1099 forms.

- Federal Tax Returns

- One or two years of tax returns are required to be shared. Lenders are interested in knowing your financial health over an extended period of time.

- Bank Statements

- By providing bank/credit union statements from the past four months, you’re able to give your lenders a snapshot of your current financial stability.

- Additional Asset Statements

- Provide all additional asset information. This means additional bank and/or credit union statements, 401k statements, stock and any other investment statements.

- Proof of Identification

- Two forms of identification, one of which is government-issued, is required. The top recommend forms of identification are driver’s license, passport and social security number.

- Liabilities and Obligations

- Mortgage lenders are interested in knowing your liabilities, obligations and long-term debts, including auto loans, credit card debt, child support, potential property taxes and insurance and overall credit rating. These items can be shown through monthly printed statements and payment receipts.

Each homebuyer and home buying process is unique, so the exact forms you may need could fluctuate based on your situation. Your mortgage officer will help you determine exactly what you need. The documents mentioned above are the most widely required for the home buying process.

If you’re looking to take the next steps, let Honor Bank help you experience the power of a Home Buyer’s Edge pre-approval. Meanwhile, if you have any questions about the home buying process, contact the Honor Bank team at (877) 235-8031 or by sending a message on the contact us page.